Seasoned commodity strategist Mike McGlone says bitcoin is now riskier relative to stocks, while he further warned that economic downturn pressures may hold silver prices at bay.

Bitcoin Volatility Low, Silver Faces Challenges: McGlone

In a client communication dated August 2, 2023, the prominent Bloomberg Intelligence analyst observed that bitcoin’s 180-day volatility, hovering near record lows around 46%, frequently heralds a favorable turn in price. However, he issued a cautionary note that the cryptocurrency’s deviation from the Nasdaq 100 starting late in Q1 might signal more widespread frailty in risk assets, especially if stocks pull back amidst usual second-half market swings, continuing Fed tightening, and receding fears of a recession.

#Bitcoin 180-day volatility is the lowest ever at about 46% at the start of August, which is typically bullish for prices. My main concern is that divergent Bitcoin price weakness vs. equities since the end of 1Q may imply pressure on all risk assets. pic.twitter.com/IJEd11tRjt

— Mike McGlone (@mikemcglone11) August 2, 2023

McGlone envisions that as mainstream acceptance grows, bitcoin (BTC) will gradually reveal attributes more akin to gold or Treasuries. Yet in the immediate future, he anticipates its lagging returns relative to tech stocks could endure if the equity market falls victim to seasonal volatility following a remarkable first-half showing. This could be exacerbated if the Federal Reserve persists with interest rate increases and the probability of a recession lessens after reaching a high point earlier this year, he explained.

Turning to precious metals, McGlone posited that only a recession-driven surge in gold might propel silver past its stubborn $30 resistance level under current conditions. With gold finding stability near historical peaks around $2,000 an ounce and silver oscillating between $23-$25, he asserts that the faltering economic indicators from China and the sharpest inversion in the U.S. yield curve in four decades lay the groundwork for silver to regress to its post-2008 average of approximately $20, instead of achieving fresh highs.

Highlighting a correlation of 0.80 between gold and silver prices since 1949, McGlone remarked that divergence is unusual and generally fleeting. In his estimation, only a marked gold upswing amidst escalating recession concerns seems poised to alter the present course of the white metal.

McGlone: ‘Bitcoin Is Riskier Now vs. the Dow’

Earlier, in March, McGlone had projected a potential bitcoin supercycle was in motion, as it overshadowed gold by nearly 10x in the year-to-date figures at that juncture. He anticipated that bitcoin’s volatility would regain its footing and trend toward unprecedented levels, assuming historical patterns remained consistent.

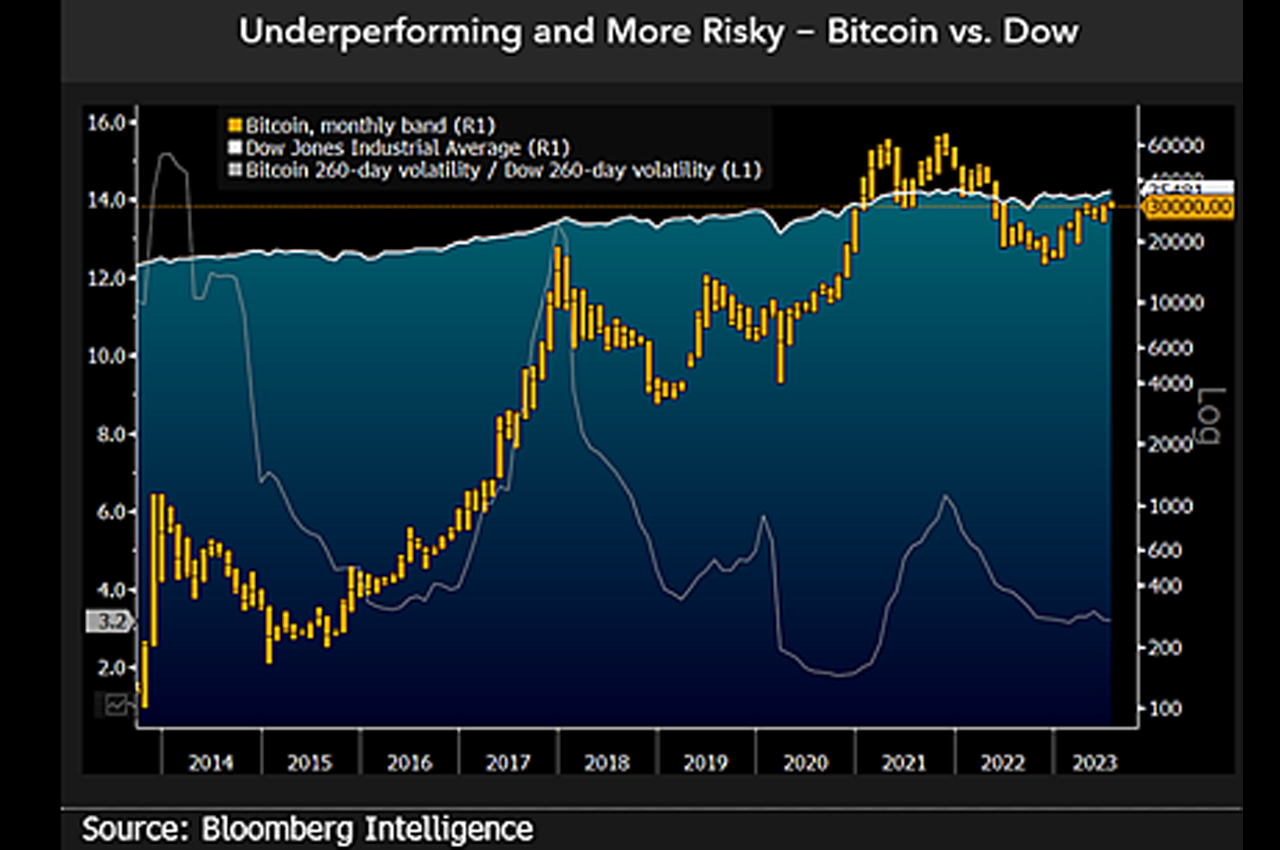

In an update on August 6, McGlone warned bitcoin (BTC) now looks riskier relative to stocks than in early 2021 when it first matched the Dow Jones Industrial Average. With crypto volatility triple the blue-chip index’s, versus less than double in Q1 2021, McGlone sees little diversification incentive supporting bitcoin unless it can boost portfolio returns.

Moreover, the strategist sees the risk of a normal recession-driven stock retreat not priced into consensus forecasts. This could pressure bitcoin, given correlation is near a historical peak of around 0.3. McGlone believes the Dow 30,000 level, matched by bitcoin when it breached $30,000 in January 2021, may remain resistance for the cryptocurrency if equities decline.

With McGlone’s insights into the complex interplay between bitcoin, precious metals, and global economic factors, what are your thoughts on the future of these assets? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/WpbEd9h

https://ift.tt/2rpo0wb

0 Comments