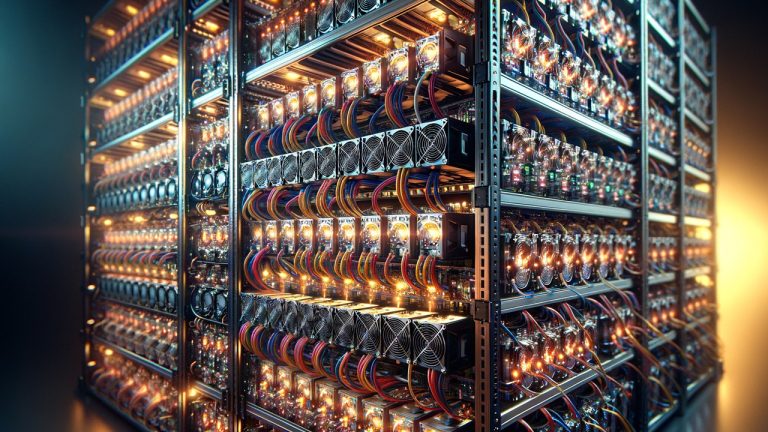

The bitcoin mining corporation Riot Platforms, a publicly traded firm within the industry, recently announced a significant expansion of its operations. The firm has completed its largest-ever acquisition of application-specific integrated circuit (ASIC) miners, securing 66,560 units of Microbt’s latest Whatsminer M66S models. This substantial purchase is set to boost Riot’s current mining capabilities by 18 exahash per second (EH/s).

Riot Platforms Amplifies Bitcoin Mining Capabilities With Record $290.5 Million ASIC Acquisition

Operating from Texas and listed on the Nasdaq, Riot revealed its monumental investment of $290.5 million in acquiring 18 EH/s of Microbt bitcoin miners, averaging a cost of $16 per terahash. This acquisition marks Riot’s most substantial investment to date. The company has also negotiated future options to purchase an additional 75 EH/s of hardware from the ASIC manufacturer.

The newly ordered 66,560 units of Microbt’s Whatsminer M66S models represent a significant step in Riot’s expansion. The Microbt ASIC machines are advanced immersion-cooled devices, boasting an efficiency rate of 18.5 joules per terahash (J/T).

According to Microbt’s product specifications, these high-performance miners are capable of generating between 270 and 298 terahash per second (TH/s). This order follows Riot’s previous purchase in June of 7.8 EH/s, comprising 33,280 Microbt ASIC bitcoin miners.

The prior acquisition is scheduled for deployment by the first quarter of 2024, while the latest 18 EH/s of immersion-cooled miners are set for operational deployment in the latter half of 2024. Jason Les, the CEO of Riot, expressed his enthusiasm for the company’s ongoing expansion in a statement released on Monday.

“We are actively building out the infrastructure at our Corsicana Facility, consistent with our long-standing, proven, vertically-integrated strategy,” he remarked. “Riot is thrilled to further strengthen our relationship with Microbt and to lay out our roadmap to reach and exceed 100 EH/s in the coming years.”

Riot has also updated its agreement with Microbt, securing an option to purchase an additional 265,000 Whatsminer models from the firm. Should Riot capitalize on this opportunity, its fleet’s capacity could soar beyond 100 EH/s. Following this announcement, Riot’s shares (Nasdaq: RIOT) witnessed a 9% increase against the greenback. Notably, the company’s stock has seen a significant 294% increase year-to-date.

What are your thoughts on Riot’s latest purchase? Let us know what you think in the comments section below.

from Bitcoin News https://ift.tt/7Ca6Epj

https://ift.tt/pwDMc1J

0 Comments