On Jan. 10, 2024, the fee for high-priority transactions is set at 42 satoshis per virtual byte (sats/vB), amounting to $2.66 per transaction. The average transaction fee stands at 98.9 sats/vB, equivalent to $11.17 per transfer. Although there has been a decline in onchain fees, they currently remain at their highest level since May 2021. Moreover, the network is still experiencing congestion with 262,143 transactions awaiting confirmation.

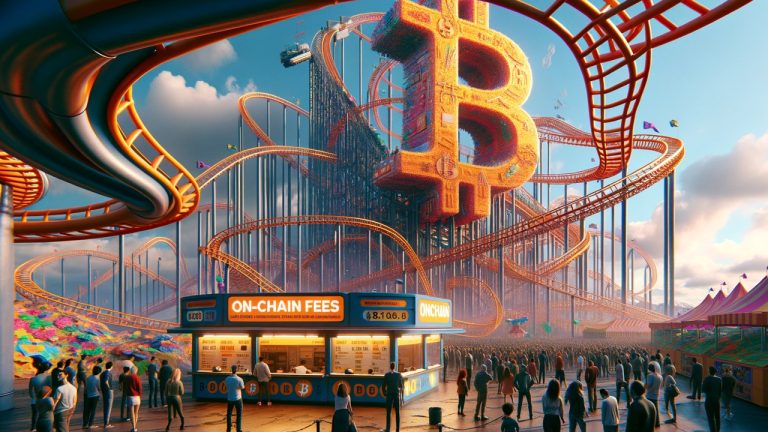

Bitcoin’s Onchain Fees Plunge Post-December Peak

Since mid-December 2023, when Bitcoin’s onchain fees peaked at $37 to $40 per average transfer, there has been a significant decrease. The average onchain fees have plunged by over 69% from that peak, currently standing at 0.00025 BTC, or $11.17 per transfer as of Wednesday. According to bitinfocharts.com, a transaction with a median size fee will incur a cost of 0.000096 BTC, or $4.32.

Data from mempool.space shows that for high-priority transactions, the cost is now 42 sats/vB, translating to $2.66 per transaction. As of Jan. 10, 2024, the fee for a no-priority transaction is $2.28 per onchain transaction. The mempool is currently clogged with 262,143 pending transactions, and block intervals are exceeding the usual 10-minute average. Mempool.space reports the average block time as approximately 10 minutes and 54 seconds.

To process all the unconfirmed transactions, it will take 546 blocks or 743.83 megabytes (MB) of block space. The backlog of unconfirmed transactions has seen a reduction over the past week, coinciding with a slowdown in Ordinal inscription mints. The Bitcoin hash price, which estimates the daily value of 1 petahash per second (PH/s) of hashing power, stands at $85.66. This figure is slightly down from the $93.05 per PH/s it reached at 7 a.m. Eastern Time the previous day, Tuesday.

Last week, onchain fees stood higher, with 351,371 transactions in the queue awaiting miner approval. The cost for a high-priority transfer was then 129 sats/vB, amounting to $7.73, marking a 190% increase compared to today’s rates. The congestion that’s plagued Bitcoin for a year now, coupled with the current fee structure, reflects the dynamic nature of Bitcoin’s network and the ongoing challenges in balancing demand, transaction processing speed, and cost.

What do you think about the latest Bitcoin network fees and the protocol’s miners grappling with congestion in the backlog? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/WsARXBl

https://ift.tt/6ROjbeF

0 Comments